- 13 October 2020

Brexit Update

At the beginning of January we informed you about the upcoming Brexit through our newsletter. Meanwhile, the United Kingdom (UK) has left the European Union (EU) on 31 January 2020 and there is now a transition period until 31 December 2020. During this period all EU rules and laws apply to the UK. For citizens and businesses almost nothing will change during this period. This time it looks like there will be no extension of the transitional period. The UK has said it does not want an extension and it remains to be seen whether or not there will be a deal.Deal or no-deal: customs formalities are an established fact. The current negotiations between the European Union and the UK are difficult. Clarity on the outcome is expected in the short term. Regardless of whether this results in a deal or a no-deal: from 1 January 2021, customs formalities will always apply to goods traded with the UK.

In recent months we as Mainfreight have therefore continued our preparations for the Brexit. We also have the ECMT permit which means that we can continue to drive to the UK with Mainfreight vehicles even in case of a no-deal Brexit with Mainfreight. We will also use the next 80 days to take care of final preparations. It’s now time to finalize the best solution together with you. We ask you to think about the incoterms and the execution of customs activities. Something where we also like to be of service to you.

Advantages customs clearance by Mainfreight

Mainfreight, with its own customsteams, is your reliable partner for handling all your customs formalities. With our specialist knowledge we are able to offer solutions for all your customs obligations that match your logistic process. Mainfreight is AEO certified with which shipments subject to customs regulations are handled quickly and efficiently.

All you have to do is hand over your commercial invoice and packing list digitally and we take care of all customs formalities for you.

ICC Incoterms® 2020

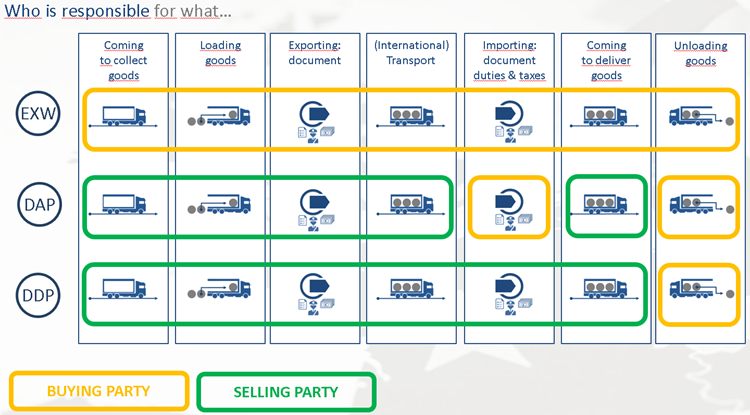

In an international transaction, buyer and seller usually agree on an ICC Incoterms® 2020 rule. This determines the rights and obligations of both parties with regard to transport, insurance, permits and customs formalities. If you are not currently trading outside the EU, you may have agreed on conditions that are unfavorable after 1 January 2021. Therefore, please pay special attention to the application of the ICC Incoterms® 2020:

Ex Works (EXW)

The Incoterm® Ex Works (EXW) imposes the fewest obligations on the seller. All he has to do is place his goods at an agreed location - often his business premises, workshop or storage space - ready for the buyer.

EXW is an "unfriendly" Incoterm® for the buyer, because he has to arrange the entire transport himself. He bears all costs associated with transport to the final destination. He also bears the risk of loss or damage to the goods from the moment he takes delivery of the goods at the agreed place. The buyer is even responsible for loading the goods into the vehicle.

EXW is not suitable for export shipments. From October 1, 2020, the exporter named in the export declaration must be established in the EU. Therefore, the buyer from outside the EU will have to find another party, such as a logistics service provider or customs broker from the EU, willing to act as exporter for the export declaration.

It also applies that the buyer is responsible to EXW for arranging an export license or other export documents, should this be necessary.

Delivered At Place (DAP)

The Incoterm® Delivered At Place (DAP) entails many obligations for the seller. The seller arranges and pays for transportation to the agreed destination. He also bears the risk of loss or damage to the goods until he transfers the goods, not yet unloaded, to the buyer at this agreed place of destination (or place of delivery).

Describe at DAP the point within the agreed place of destination as clearly as possible. Because this is the place where the risk of loss or damage to the goods passes from the seller to the buyer (place of delivery). The buyer bears the costs of unloading at the agreed place of destination.

If the destination of the goods is outside the European Union (EU), the seller must arrange the export declaration with the customs. Furthermore, he is responsible for arranging an export license or other export documents, if necessary. For imports into the destination country, the buyer shall arrange customs formalities and payment of any import taxes. If necessary, the buyer also requests local import documents (e.g. an import permit).

Delivered Duty Paid (DDP)

The Incoterm® Delivered Duty Paid (DDP) brings with it most of the obligations for the seller. He arranges and pays for transportation to the agreed destination. He is responsible for customs clearance and pays any import duties in the destination country, such as import duties and/or import VAT. Furthermore, he bears the risk of loss or damage to the goods until he transfers the goods, not yet unloaded, to the buyer at the agreed place of destination (or place of delivery).

Please describe to DDP the point within the agreed place of destination as clearly as possible. Because this is the place where the risk of loss or damage to the goods passes from the seller to the buyer (place of delivery). The buyer bears the costs of unloading at the agreed place of destination.

At DDP, you are also responsible for customs clearance in the country of destination. In that case, you will bear the costs associated with customs clearance, including any import taxes due such as import duties, import VAT or other local import duties. You also have to provide any documents required to clear the goods, such as an import license.

Volumes and capacity Q4 2020

We are currently seeing an increase in volume from and to the United Kingdom among our customers. We expect 3 extra busy months of Brexit related volume. We ask you to inform us early on your increasing volumes so we can take this into account in our planning and capacity. Should it be the case that we cannot handle the increasing volumes in combination with the available capacity, we will inform you further.