- 26 September 2021

Service Announcement New Zealand | 24 September 2021

Foreign Market Overview and GRI Notice

New Zealand

Overview

- The high demand for space and equipment for both import and export cargo remains and we continue to urge customers to provide forecasted volumes 6-8 weeks in advance.

- Pressure remains on south-bound bookings from many parts of the Northern Hemisphere and New Zealand trading partners. Carriers continue to announce General Rate Increases (GRIs) on a fortnightly to monthly basis from some ports, as provided in the previous Market Update. Please work with your local Mainfreight team to source alternative services and/or updated costings.

Imports

- Import container de-hire depots continue to be over-capacity. Our dedicated Mainfreight Port Operations division continues to work through solutions on a day-to-day basis when de-hiring containers.

- TS Lines, a Taiwanese shipping line has announced a new service to New Zealand with the first departure scheduled for 27 September. Vessel options will be available from the below ports calling directly to Tauranga and servicing Auckland via Metroport. The schedule will be fortnightly until mid-November at which point vessels will move to a weekly rotation. This is welcome volume and Mainfreight has been working closely with TS Lines over the past eight weeks to secure allocation on all vessels and understand their service ability.

| TS Line Service - Ports of Origin |

|---|

| Qingdao |

| Shanghai |

| Ningbo |

| Nansha |

| Shekou |

Tauranga Port / Auckland Empty Container De-hire

- Delays from Tauranga through to Metroport via rail continue to affect import shipments. Delays are averaged at between 12 to 14 days for general bookings and 3 to 5 days for Shuttle Connect (priority) bookings. As we have previously seen, this will take time to work through and delays are expected to worsen over the next 1 to 2 weeks. Mainfreight customers are being updated on a per-shipment basis. Please continue to provide timely documents for import customs clearance as pre-clearance improves any potential delay. Additionally, if the need for containers is extremely urgent, our team can assist with trucking from Tauranga.

- Mainfreight continues to work hard to avoid detention/demurrage costs for our customers. Empty parks in Auckland remain at critical capacity, with some shipping lines not accepting the return of empty containers. Our dedicated Port Operations team and delivery coordinators are working closely with empty de-hire parks to manage the return of empty containers. Many attempts are required to ensure de-hire can occur and multiple de-hire parks are often engaged. Our operations team are also working with customers to avoid the de-hire requirement altogether with solutions to manage import container flows by reusing for export shippers.

LCL

- Given the on-going delays at local New Zealand ports, Mainfreight continues to review its LCL services on a regular basis. We are able to make the decision to adjust the container discharge port to benefit customers’ overall door-to-door transit time. We are using our local infrastructure in New Zealand to allow us to manage this process and give our customers an increased level of service. These adjustments are only made when an improved final mile transit is possible.

Air

- Airfreight remains relatively undisrupted with minimal changes to capacity since our last update. While rates still remain inflated, our teams at our airfreight gateways are managing to find connection solutions for our customers providing a range of options including premium direct options, through to slower economy options using air-to-air or air-to-sea connection services. To control quality and mitigate transit risk, our air-to-air and air-to-sea connection options are managed in-house in our own global airfreight hub facilities.

Foreign Market Summary

Asia

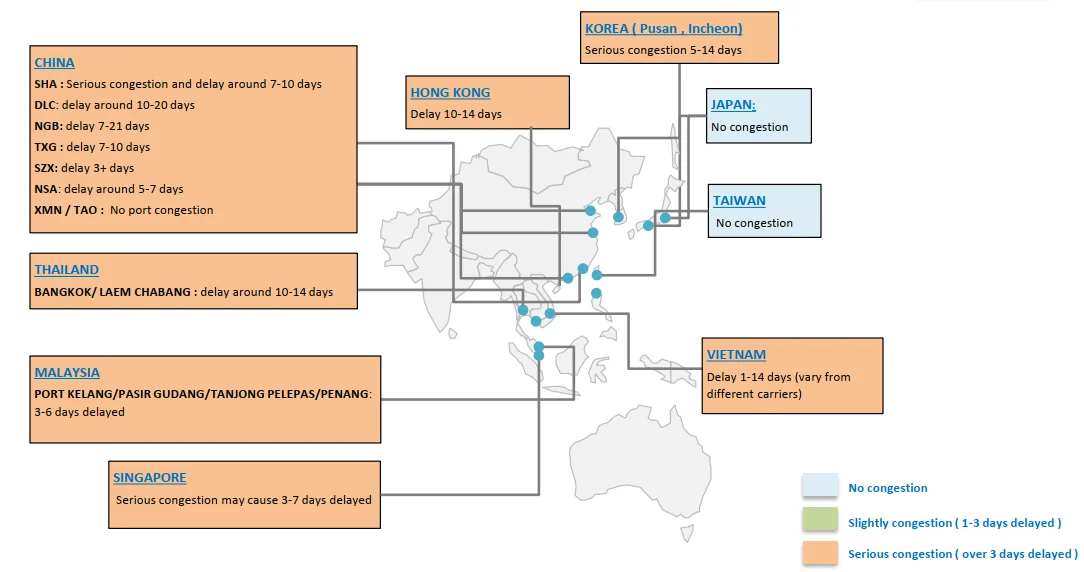

- A summary of the current congestion at major port hubs is below.

- Mainfreight has secured further space allocation from the following ports based on loading NOR containers only – Singapore, Laem Chabang, and Ho Chi Minh. If this origin, container volume, and type is of interest, please reach out to your local Mainfreight team.

- Singapore tranship cargo continues to be delayed. Please allow for 3 to 6 weeks delay in transhipping cargo.

Australia

- Trans-Tasman shipments to and from New Zealand continue to be effected by port omission, reduced discharge port calls and increased container volume. Carriers are imposing significant rate increases on both East and West bound container shipments. Summary of cost increases will be provided to affected customers by the Mainfreight team. We have summarised LCL increases below to come into effect from October 1.

- MSC have announced that they are now not accepting new bookings ex Brisbane as their Southbound Asia service continues to be severely overbooked.

USA

LAX/LGB Terminal Update

There are currently 65 ships (+31) at anchor awaiting berths in LAX/LGB as of Friday Sept 17th. Ships are waiting average 9-11 days to catch a berth. . Both ports are seeing record volumes month after month. Volumes are up 30% so far this calendar year. The delays are forcing ships to wait at anchor are expected to continue for the remainder of the year.East Coast Summary

Berth utilization and congestion continues to be very high and is expected to extend through the end of September. Current vessel delays now running up to 5 - 10 days versus published shipping line schedules. For some services, berth congestion in New York is impacting arrivals in Philadelphia and causing vessel bunching and delay. Savannah is showing 23 vessels awaiting berth with an average wait time of 5 – 7 days. Vessels are being discharged on a first come first serve basis.In Land Operations

There is capacity limitation in most parts of the USA due to import volume spikes and severe drivers’ shortage. Our teams are working hard with our network of truckers to ensure our customers shipments continue to move on time and meet required cut off dates. Please allow for extended wait times on both import and export trucking and continue to provide forward forecasts.Chassis Pools

With the recent increased import volumes, there is currently a historically high demand for chassis throughout the USA. This demand has shown to be persistent on 40ft chassis and intermittent on 20ft chassis. In order to minimize any negative impact on supply chains, carriers are asking customers to take steps to reduce container and chassis off terminal dwell time. This includes all inland terminals as well as port terminals. If extended dwell times continue, truckers may face serious challenges and delays in securing good order chassis as long as this surge in imports continues. Chassis wait times currently range between 8 – 14 days depending on discharging location.Europe

- Delays in Singapore continue to effect south bound European origin cargo. Please make allowances in forecasts for this delay.

- CMA CGM’s recent announcement in regard to restricting further rate increase has them partly offset a significant GRI with the removal of their Peak Season Surcharge on Europe origin shipments, adjustments will be made to customer rates and quotes.

- Further allocation is available ex Europe via South East Asia (Port Klang) where our shipping line partners have reported an ease in tranship cargo.

- Additional allocation for export bookings can be secured to Europe if provided appropriate lead times. Please reach out to your local Mainfreight contacts to understand potential volume to this region.

GRI Summary

- The below table outlines adjustment in charges applicable from the effective date noted. Please note Mainfreight continues to strive for cost reduction and recovery for our customers. We are regularly engaging with shipping lines to discuss increased allocations and challenging market competitiveness. Additionally, we continue to promote a multi-mode supply approach given the environment, please discuss with your local Mainfreight contacts how this can be achieved.

- Export LCL via Singapore and Korea has also seen increases on final voyage from the tranship hub. These vary based on destination. Our team will be adjusting costs based on upcoming shipments and quotes requested.

| GRI UPDATE - LCL | ||||

|---|---|---|---|---|

| Origin | Destination | Value | Effective | Details |

| Auckland | Sydney & Melbourne | USD 15.00/CBM | ETD 1/10/2021 | GRI |

| Lyttleton | Sydney & Melbourne | USD 10.00/CBM | ETD 1/10/2021 | GRI |

| NZ - All Ports | Brisbane | USD 10.00/CBM | ETD 1/10/2021 | GRI |

| NZ - All Ports | Fiji | USD 10.00/CBM | ETD 1/10/2021 | GRI |

| Sydney, Melbourne, Brisbane | NZ - All Ports | USD 20.00/CBM | ETD 1/10/2021 | GRI |

| Los Angeles | NZ - All Ports | USD 15.00/CBM | ETD 1/10/2021 | GRI |

| United Kingdom | NZ - All Ports | USD 20.00/CBM | ETD 1/10/2021 | GRI |

| Italy, Netherlands | NZ - All Ports | USD 5.00/CBM | ETD 1/10/2021 | GRI |

| Qingdao | Auckland | USD 45.00/CBM | ETD 1/10/2021 | GRI |

| Hong Kong & Other Origins via HK* | Auckland | USD 36.00/CBM | ETD 1/10/2021 | GRI |

| Hong Kong & Other Origins via HK** | Lyttelton | USD 6.00/CBM | ETD 1/10/2021 | GRI |

| Singapore*** | NZ - All Ports | USD 45.00/CBM | ETD 1/10/2021 | GRI |

*Dalian, Fuzhou, Guangzhou, Huangpu, Jiangmen, Xiamen, Xingang, Zhongshan, Zhuhai, Kobe, Nagoya, Osaka,Tokyo, Yokohama, Busan, Kaohsiung, Keelung, Hong Kong

**Dalian, Fuzhou, Guangzhou, Huangpu, Jiangmen, Ningbo, Qingdao, Shanghai, Shenzhen, Xiamen, Xingang, Zhongshan, Zhuhai, Hong Kong, Kobe, Nagoya, Osaka, Tokyo, Yokohama, Busan, Kaohsiung, Keelung

*** All origins where routings tranship via Singapore will incur above increase. Please check at time of booking or quote request.

Click here for previous Market Updates and our current sailing schedules

Glossary

| Glossary | |

|---|---|

| LCL | Less than Container Load - Seafreight |

| FCL | Full Container Load - Seafreight |

| NOR | Non-Operating Refrigerated Container |

| Reefer | Refrigerated Container |

| BMSB | Brown Marmorated Stink Bug |

| GP | General Purpose Container |

| HC | High Cube Container |

| GRI | General Rate Increase |

| LP | Lyttelton Port |

| POAL | Port of Auckland |

| POT | Port of Tauranga |